So how do you calculate your hourly rate? That’s easy, it’s the salary you want to make, divided by 52 weeks a year, divided by 40 hours a week. Simple!

Right, right?! It’s a tad more complex than you might thing at first:

Next to showing one how to calculate the minimum rate, it also holds some golden advice:

If you go below your minimum rate, even for a friend or charity, you are hurting yourself and your business. There is no shame in passing on work, if you are putting yourself in financial trouble.

Kleine denkfout.

52 weken per jaar, 40 uur per week?

Dan hou je geen rekening met:

– vakantie

– onderzoek, bijscholing

– tijd gespendeerd aan prospectie en sales

– tijd voor administratie

Best de link volgen — Eindformule komt op volgende uit:

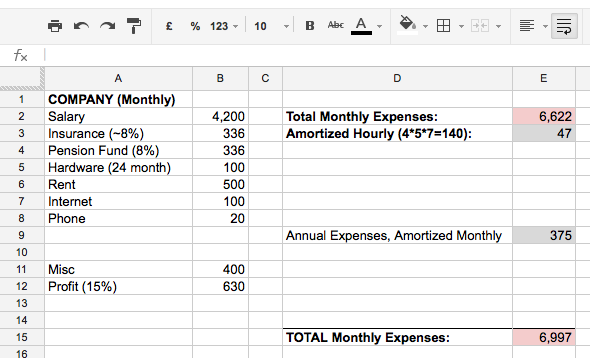

In België is de loonberekening wel een beetje ingewikkelder: om te beginnen is de belasting in schalen. Dan heb je BTW wat je in principe terugkrijgt op uitgaven, maar niet altijd. Etc, etc 😉 het heeft me meer dan 2j geduurd eer ik een spreadsheet had die min of meer simuleert wat ik verdien.

Should be noted indeed that the rate calculated is the income sans VAT, after taxes.